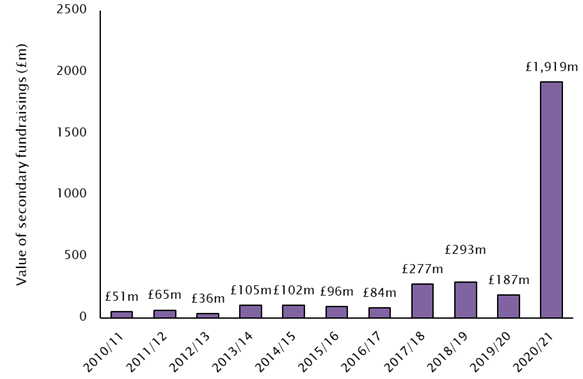

Value of UK stock market fundraisings by retail companies jumps tenfold in a year

Funds raising turns from repairing balance sheets to funding M&A opportunities

Last year saw a ten-year high in secondary fundraisings by UK listed retail companies, with the value of placings and rights issues on the London Stock Exchange reaching £1.9bn (year end March 31), ten times more than the £186.7m raised in the previous year, says RPC, the City-headquartered law firm.

RPC says online retailers, in particular, have been using those additional fundraisings to take advantage of M&A opportunities created by COVID -19 related disruption to the sector.

Fashion retailer Boohoo raised £197m to help fund acquisitions of struggling brands and has recently announced the £55m acquisition of Debenhams. ASOS, which raised £246.6m last year to strengthen its balance sheet, has now acquired the Topshop, Topman and Miss Selfridge brands from the Arcadia portfolio.

E-commerce businesses have also been raising funds in order to capitalise on organic growth opportunities created by the accelerated shift to online sales under the “lockdown” for example, Ocado raised £650m through a placing of new shares to fund its expansion.

The share of retail sales made online hit 36% last year, up from 21.6% from the same period the year before, as many bricks and mortar shops were forced to close during national and regional lockdowns.

Jeremy Drew Co-Head of Retail at RPC says that the recent rally in the sector’s share prices suggests that those retailers that did make acquisitions during the worst of the COVID crisis may have made very well-timed acquisitions. The FTSE-350 General Retailers Index has risen by 56% in the last year (to April 16) and now stands 18 % above their Jan 1 2020 pre-COVID level.

“Some retailers have dealt with an unprecedented crisis very well. They used depressed valuations to make good strategic acquisitions. They raised money to defend their balance sheets which has kept their banks and suppliers onside. They’ve also used the crisis as a catalyst to raise extra cash to accelerate the growth of their online offerings.”

“The pandemic is going to throw up more opportunities for bidders of distressed retail assets. The recent acquisition of Jaeger by Marks & Spencer shows that new players are now in this market.”

Stock market fundraisings during the first half of the COVID have been important for some retailers who have been unable to operate normally due to the lockdown. Constant changes to restrictions during the pandemic, means bricks and mortar ‘non-essential’ retailers have been forced to close at little notice, leaving lower revenues and many with surplus stock.

RPC says this dramatic rise in funds raised shows some of the benefits of being listed during times of economic stress.

Adds Jeremy Drew: “Despite a turbulent year, investors have cast a big vote of confidence in retail. The sector wants to invest to continue its transition and institutional investors have been willing to look past the pandemic and provide this to traditional high street as well as e-commerce businesses.”

“As we reach the end of this crisis, we expect fundraising to further shift towards M&A and investing more heavily in warehouses (including automation), logistics and other ecommerce related capital expenditure.”

RPC point out that whilst internet sales reached 36.4% of retail sales in January, they have fallen back to 32.8% in March as consumers deferred online purchases ahead of the reopening of physical stores in April.

Value of secondary fundraisings on London Stock Exchange by retail companies hits decade high in 2020

**Office for National Statistics: November 30

Stay connected and subscribe to our latest insights and views

Subscribe Here