HMRC faced 36% more Judicial Reviews last year as it adopts a more aggressive approach towards taxpayers

HMRC has in recent years become more aggressive in dealing with taxpayers, which has led to an increase in taxpayers challenging HMRC in the High Court where it has overstepped its authority or acted unfairly.

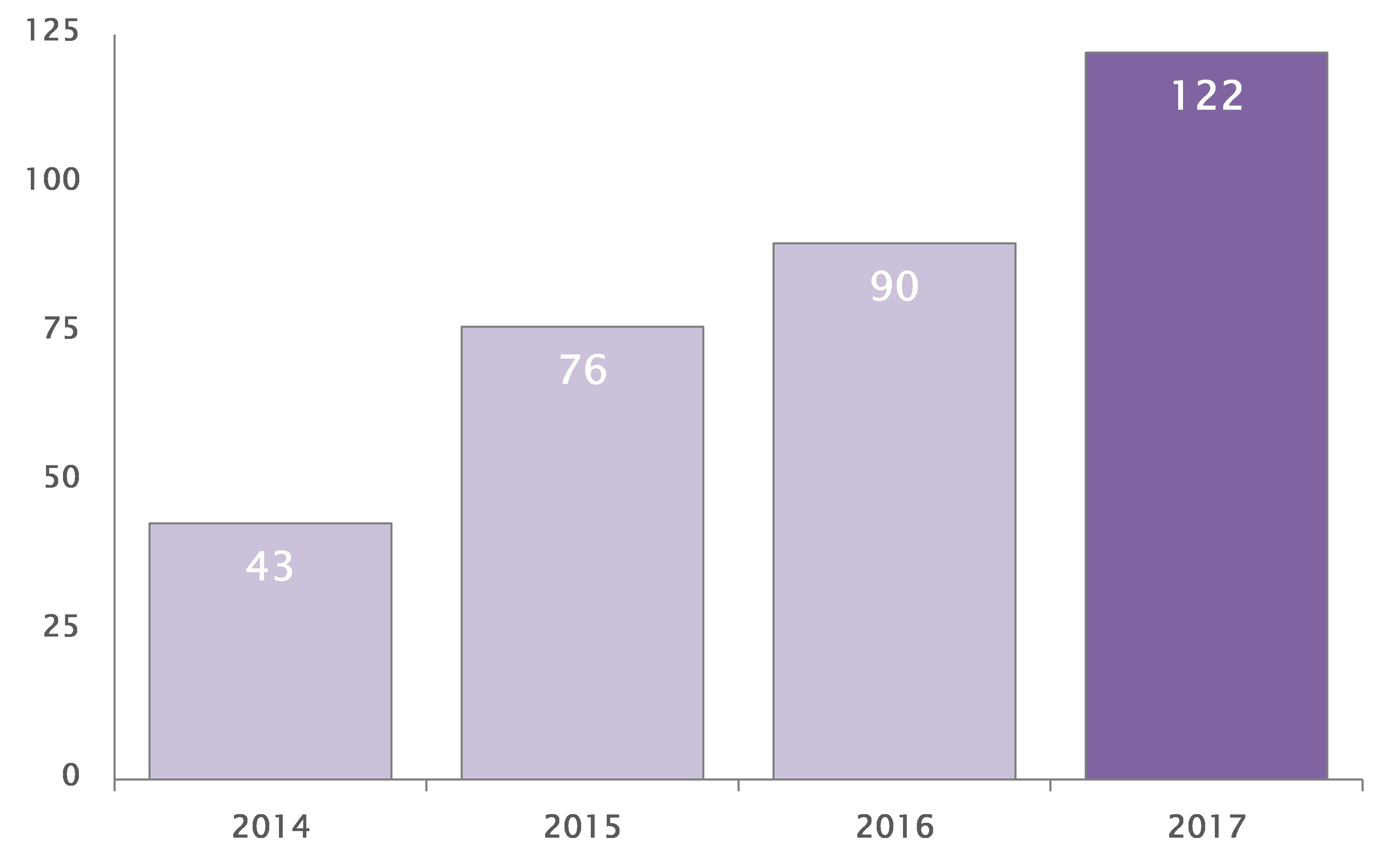

HMRC faced 122 Judicial Reviews last year, up 36% from 90 in 2016, says RPC, the City-headquartered law firm.

The firm says that HMRC is under considerable political pressure to hit targets and increase tax revenues and this can lead to HMRC adopting a very dogmatic and aggressive approach which can leave it vulnerable to legal challenges by taxpayers.

Recent issues at stake in judicial reviews against HMRC include:

- HMRC issuing information request notices to taxpayers who were not within its jurisdiction

- HMRC making retrospective changes to the treatment of Customs Duty

- Cases where HMRC ignored its own published guidance in relation to rules on residence and the National Minimum Wage

RPC says that the rising number of Judicial Review applications are a sign that HMRC is increasingly exceeding its powers and acting unfairly towards taxpayers.

Adam Craggs, Partner and head of the tax disputes practice at RPC explains that it is vital that taxpayers and their advisers consider whether it is appropriate to challenge HMRC's actions through a Judicial Review when they consider HMRC is behaving unfairly or acting beyond its powers.

Adam Craggs comments: “HMRC’s increasing aggression and intransigence mean that Judicial Reviews are becoming far too common and are all too often the result of simple errors by HMRC and a dogged refusal to correct them.”

“This substantial increase in Judicial Review challenges would suggest that taxpayers are not prepared to be treated unfairly by HMRC and are willing to challenge its decisions and seek redress from the High Court.”

“We have seen a number of cases in the last 12 months where HMRC has withdrawn its decision once it became apparent that our clients intended to issue Judicial Review proceedings. It is regrettable that taxpayers are forced to take such action before HMRC acknowledges its mistakes and does the right thing.”

Number of Judicial Reviews faced by HMRC jumps again as tax authority gets more aggressive

Stay connected and subscribe to our latest insights and views

Subscribe Here