E-retailer takeovers rise as high street decline increases pressure to grow online sales

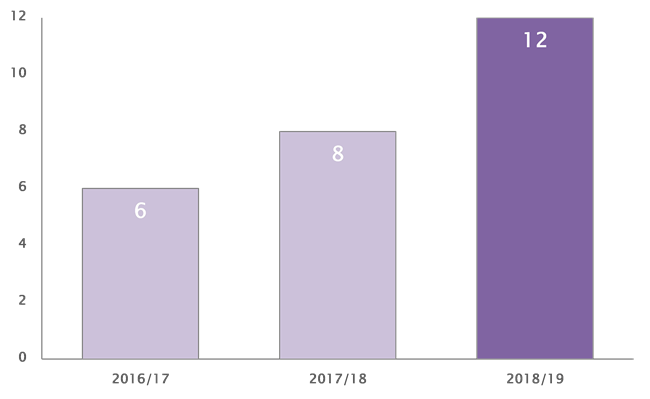

The number of M&A deals for UK e-retailers has risen to 12 in the past year*, up from eight last year, says City-headquartered law firm RPC.

- Need to acquire e-retail platforms drives up valuation premiums

- Retailers looking to access established niche customer bases

The number of M&A deals for UK e-retailers has risen to 12 in the past year*, up from eight last year, says City-headquartered law firm RPC.

RPC says that retail groups have been under pressure from shareholders for a number of years to accelerate growth in their online sales. That pressure has been raised in the last 12 months by the problems facing high street retailers. Retail footfall declined 1.3% in August 2019 compared to August 2018.

Some are responding to this increased pressure by acquiring pureplay e-retailers rather than just trying to organically grow their existing e-retail offering, says RPC.

The firm explains that acquisitions of e-retailers often form part of retail groups’ strategy to catch up on previous underinvestment in the online channel. That has made some online retailers more attractive as takeover targets – especially if their tech platforms and logistics systems are well-developed.

Neil Brown, Partner at RPC, comments: “The platforms behind online retailers can be hugely valuable in their own right. For retailers under shareholder pressure to deliver increased online revenue, a bolt-on acquisition can quickly deliver the technology and sales boost they need.”

“Investors are impatient with any high street retailer that is only increasing its online sales by low single digits. They want quicker results, and that means acquisitions.”

There have also been a number of deals in the past year where established retailers have acquired specialist online retailers with a sizeable share of a niche market. Examples of these deals have included the acquisition of a UK dance apparel retailer by an American competitor, and the purchase of an upmarket online shoe retailer by a well-known high street footwear chain.

RPC adds that the need to expand market share and acquire online platforms has made some retailers willing to pay higher prices to purchase the right e-retailers.

Adds Neil Brown: “The size of the online retail market now means that supposedly ‘niche’ markets can be extremely valuable, especially if one e-retailer has a well-established following and a significant share of that market.”

“Building up a portfolio of these specialist online retailers can be a viable way for a retail group to grow its overall market share and benefit from brand loyalty that has been built up.”

Takeovers of e-retailers rise as shareholder pressure prompts retail groups to accelerate online sales growth

* Year end June 30 2019, source: Mergermarket

** Source: British Retail Consortium/Springboard

Stay connected and subscribe to our latest insights and views

Subscribe Here