15% rise in number of M&A deals in the retail sector last year

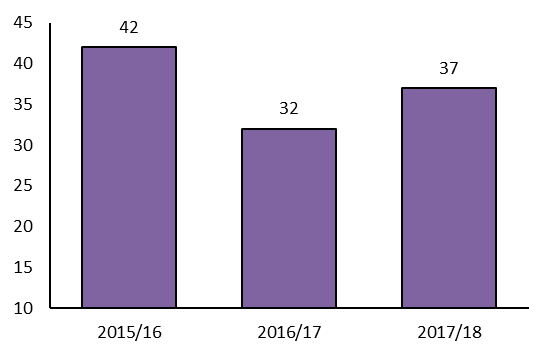

The number of UK retail sector M&A deals* has jumped 15% in the last year to 37 up from 32 in 2016/17 (year end March 31).

RPC says that the Asda/Sainsbury’s merger continues the recent trend in the food side of the retail sector, in which existing large incumbents are using M&A to add economies of scale to make up for slowing organic sales growth.

The biggest increase in deals has been in the fashion/clothing retail sector with the number of M&A deals more than doubling from five to 12 in the last year. However, many of these have been relatively small when compared with the higher-value M&A deals taking place in the food retail sector.

RPC’s research shows that, as a result, whilst the number of retail sector M&A deals has jumped, the aggregate value of those deals fell 16% last year to £3.7 billion in 2017/18, from £4.3 billion the previous year (data excludes Sainsbury’s/Asda deal).

RPC says that the weak demand for retail sector IPOs amongst institutional investors is helping to spur M&A deals. Trade sales to competitors now seem a much more certain method for existing investors to exit a smaller retailer than an IPO that might have to be cancelled due to short-term volatility or poor sentiment towards the sector.

Karen Hendy, Corporate Partner at RPC, comments: “Despite some notable exceptions, such as Joules, which continues to report impressive results since its 2016 listing, overall retail sector IPOs have fallen. That means investors looking for an exit are focused on selling to other retailers rather than going to the stock market.”

“Through mergers such as Asda and Sainsbury’s, market leaders are looking beyond all the hype about the 'meltdown of the high street' and getting on with building breadth of offering and scale.”

RPC says that there is also relatively healthy interest in buying distressed retailers’ assets but that these needed to be at substantial discounts. The number of retailers entering insolvency has increased by 7% in the past year, from 999 in 2016/17 to 1,071 in 2017/18 (year end March 31).

Adds Karen Hendy: “It is important that sellers and creditors are sensible over the prices they are expecting from M&A deals in the current climate.”

Deals among large British-owned companies announced in 2017/18 include:

- The Co-Op’s approach for Nisa, valued at £243m;

- Tesco Opticians’ acquisition by Vision Express owner Grandvision;

- Multiyork Furniture’s acquisition by DFS

*Based on deals announced in the year ending March 31 2018

Stay connected and subscribe to our latest insights and views

Subscribe Here