Adam Craggs

Partner

London

If your organisation is unexpectedly the subject of a dawn raid, a regulatory investigation or is dealing with a workplace accident, you need a reliable crisis response team in your corner to navigate crisis incidents and avoid the pitfalls.

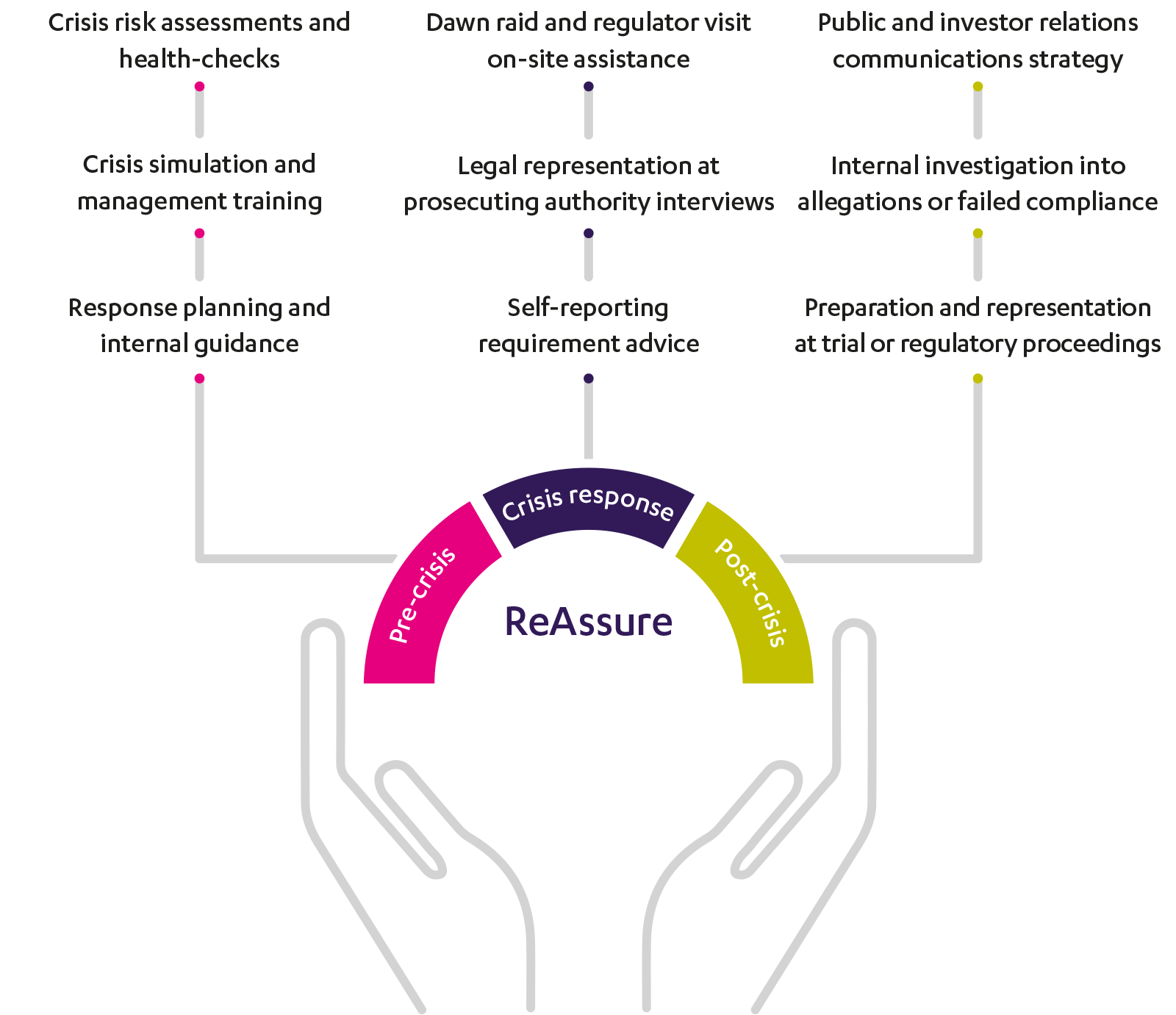

That’s where our ReAssure product comes in. All it takes is one call to bring together experts from across RPC, giving you access to clear legal and regulatory advice, as well as the best communications and public relations expertise.

ReAssure provides the support you need throughout a crisis situation, helping you manage, investigate, resolve, and recover.

Today’s focus on transparency demands a coordinated approach to any crisis. We understand the stress you’re under and the potential damage a crisis could do - we’re here to help you minimise reputational risks with a swift and effective response.

Our crisis management lawyers have proven track record in managing legal and PR challenges, combined with our deep regulatory expertise, means we can help you confidently navigate crises like dawn raids, workplace accidents, regulatory or criminal investigations, and product recalls. Know that our number one priority is to protect you and your interests.

Don't face a crisis alone. Partner with a crisis management firm that knows how to protect your interests and guide you through to resolution.

Thinking - Blog

Court of Appeal confirms that compensatory payments made to settle regulatory investigations are not penalties

Topic: Tax Take

10.04.2025

Thinking - Blog

Business Briefing: Navigating The New US-UK Trade Tariffs

Topic: Tax Take

07.04.2025

RPC has a highly experienced team in complex financial crime matters.

RPC has some of the leading cyber breach lawyers in London providing expertise on issues like data theft and third-party actions. With strength and depth across the team, I would absolutely recommend.

RPC have a great understanding of the legal matters referring to the cyber world and they are able to understand the legal strategy regarding the media.

Stay connected and subscribe to our latest insights and views

Subscribe Here